Financial Forecasting 101: Why, When, And How - Issue 38

How and when to apply revenue forecasting for data analysis

Financial forecasting is not only applicable for finance (as one might think). You also have to apply it for various product or marketing-related projects. It is the most common type of analysis and often functions as the foundation of getting growth rates for revenue data. You would use it to forecast not only revenue growth but also to estimate and predict the ads spend, upsell impact, promotion cost, and more. In this issue, I will cover different types of forecasting you have to work with along with some use-cases for each.

Important: forecasting has many techniques. Depending on what you forecast - revenue, sales, stocks, or your neighbor’s Amazon deliveries - your approach will be very different. In this article, I omit financial modeling and specifics of financial prediction of income statements for gross or operating margin, expenses, SG&A, and others focusing more on growth and product-related projects you are more likely to work on as a data or product analyst.

Overall, there are 4 main types of revenue forecasting:

Historical Growth Rate (or Straight Line)

Moving Average

Simple Linear Regression

Multiple Linear Regression

Make sure to get some coffee and let’s break down each of these.

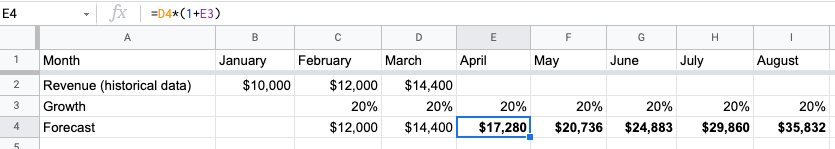

1. Historical Growth Rate

Historical Growth Rate is also known as a Straight-line forecast in finance. This is the simplest and fastest revenue prediction that doesn’t require any statistics or modeling and is best suited for businesses with a constant growth rate.

Keep in mind that straight-line only works if you assume the data pattern won’t change or fluctuate much. For example, your year-over-year growth is 10% and there are no big external factors that might affect it.

Methodology: take the previous year and multiply it by the growth rate:

Previous month revenue x (1 + % growth) = next month’s revenue

Let’s assume your last month’s revenue was 12K and your month-over-month growth is 20%:

12,000 x (1 + 0.2) = 14,000

As the formula is fairly simple, it gives you a rough look into how your revenue performs based on the growth rate you have.

2. Moving Average

Moving average basically means repeated forecasts. It is a smoothing technique to normalize data spikes and works the best for short-term predictions (and usually for monthly, not yearly). It’s called moving because the average for the time period is moving forward and gives you a dynamic forecast. The most common are 3 months or 5 months moving averages. Moving average also requires a good sample of historical data.

Methodology:

The sum of the previous month revenue / total number of months = next month’s revenue

Read more on how to calculate moving average forecast

Use cases: stocks predictions, profit, revenue, sales growth. Given 5 months of data, predict the sixth month for stock performance, revenue, or whatever variables you may be working with.

3. Simple Linear Regression

Simple Linear Regression is the most common forecasting approach to get a projected average cost. This is the built-in TREND function in Excel. Most analytical software you use has this projection available.

To calculate it, your dataset should have one independent variable with one dependent. You would use LR over Moving average or Straight-line when there is no historical data available, and you don’t expect a lot of data fluctuation. For regression, you would just need a cleaned sample of observation.

Methodology: for the regression modeling approach you can use either built-in TREND functions in Excel or Sheets (for this, insert a chart Scatter and in the Format Data Series click on Trendline or simply use FORECAST function) or follow this guide about how to run a simple regression forecast in R.

Regression analysis to forecast sales

Use case: how ads affect revenue, what impact upsells are making on revenue. By adding a few new product features, how much we can expect revenue increase, and etc.

4. Multiple Linear Regression

This is a more complex forecasting method that helps you identify relationships between multiple variables. Your input data should have multiple independent variables with one dependent.

Input data:

Methodology: Same as above. For excel, go to Data Analysis → Regression. Select your date range and set the output. For Python, check these guides and tutorials:

Use cases: what is the estimated promotion cost, how much we can spend on ads, how revenue is correlated with marketing campaigns, the relationship between sales and profits, etc. If we increase the cost per conversion, how much that would affect the profit, and so on.

There are additional forecasting techniques I didn’t cover - time series, run rate, naive forecast, qualitative forecasts - research, Delphi method. Python and R offer many ML packages that can help you build the forecast, but the trick is to know which forecasting method is appropriate depending on how much (and what) data you have, and what your objective is.

❗Things to keep in mind working with financial data and forecasts:

There are many different forecasting techniques — both statistical and qualitative — and which one you use depends on many factors (value, context, properties, data availability, cost, accuracy, etc). Financial forecasts aren’t an exception, and each method for financial data prediction can be also classified as conservative or aggressive.

The Conservative approach takes into consideration aspects that make your prediction safer:

low price point (if there are multiple subscription plans)

1 or 2 marketing channels for promotion and user acquisition

low sales team (if applicable)

no new products or features over the forecasted time period

The Aggressive methodology would aim high based on:

higher price point (if there are multiple subscription plans)

multiple marketing channels for promotion and user acquisition

new released features over the forecasted time period

Ideally, in a perfect world, you run the forecast against both approaches and lean towards the median. This would give your leadership team some perspective about how aggressive they can be in planning marketing campaigns, releasing new features, or investing in product support. In the real-world scenario, you often don’t have enough insights or visibility into many external factors affecting your forecast. Therefore, working with revenue data, it’s a good practice to communicate your outcome as an estimation leaning towards the conservative approach. Trust me, it’s better for your karma.

I hope this helps! Until next Wednesday!